The future of sports streaming in Europe: Maximizing the potential of D2C

As the sports streaming market grows in Europe, increased fragmentation seems inevitable. The market for sports rights remains hugely competitive with new entrants including DAZN and Prime Video competing with established players such as Sky, Warner Brothers Discovery and Movistar.

Streaming live sports means consumers get more choices and can tailor services to their exact needs, but those looking to stream multiple sports could end up paying more than a traditional pay-TV package with subscriptions from multiple providers.

This fragmentation creates discovery challenges too, making it harder for fans to find what they want to watch, and managing multiple services is a complex user experience at present.

In the United States, the direct-to-consumer (D2C) approach to streaming for major properties such as the NFL, NBA and MLB is finding success. While these numerous offerings do mean fragmentation for US consumers, NFL Game Pass, NBA League Pass and MLB.TV gives fans access to every game, plus exclusive VOD content – an offering that seems to hit the mark.

US consumers also benefit from free-to-air TV access for a majority of NFL games, plus local market broadcasts for the other major leagues, which is in stark contrast to many sports in Europe which are distributed exclusively by pay-TV or subscription OTT services.

In Europe, the biggest sports streaming player is DAZN, which reported 15 million paying subscribers at the end of 2022. With rights to the UEFA Champions League, La Liga, NFL, NBA, UFC and Matchroom Boxing across various territories, DAZN has enjoyed rapid growth since its launch.

DAZN has shown you can scale a sports-only streaming service. Although this has included broadening its commercial model to support free-ad-supports (FAST) channels, and distribution via pay-TV operators, to broaden its reach on linear TV. The challenge for new entrants like DAZN is balancing the cost of media rights with an economic model which is quite different to pay-TV.

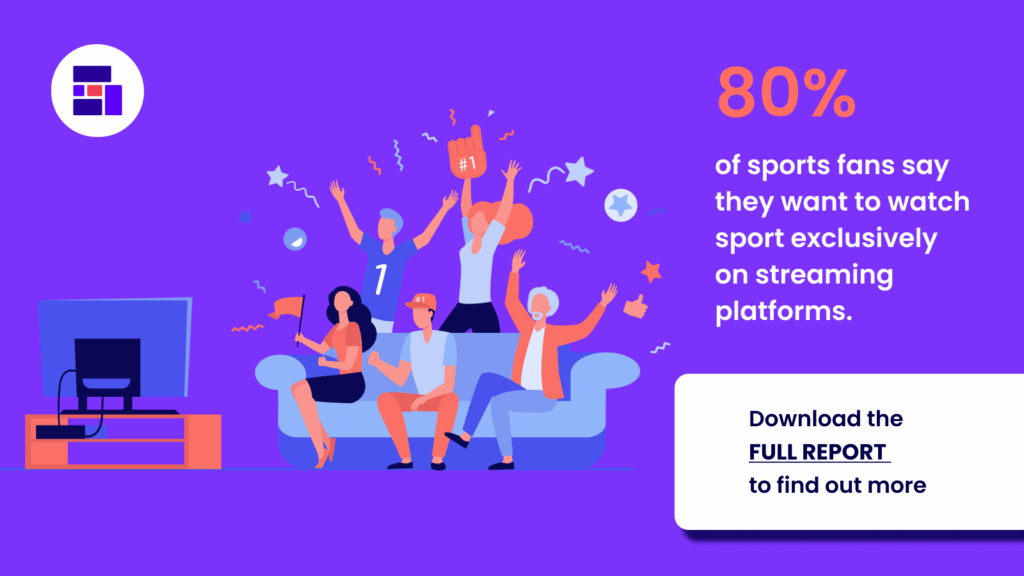

What this all shows us is that globally, sports fans are ready for streaming in live sport.

But streaming does not yet capture the entire sports fanbase, which has created a hesitation shared by many major sporting properties.

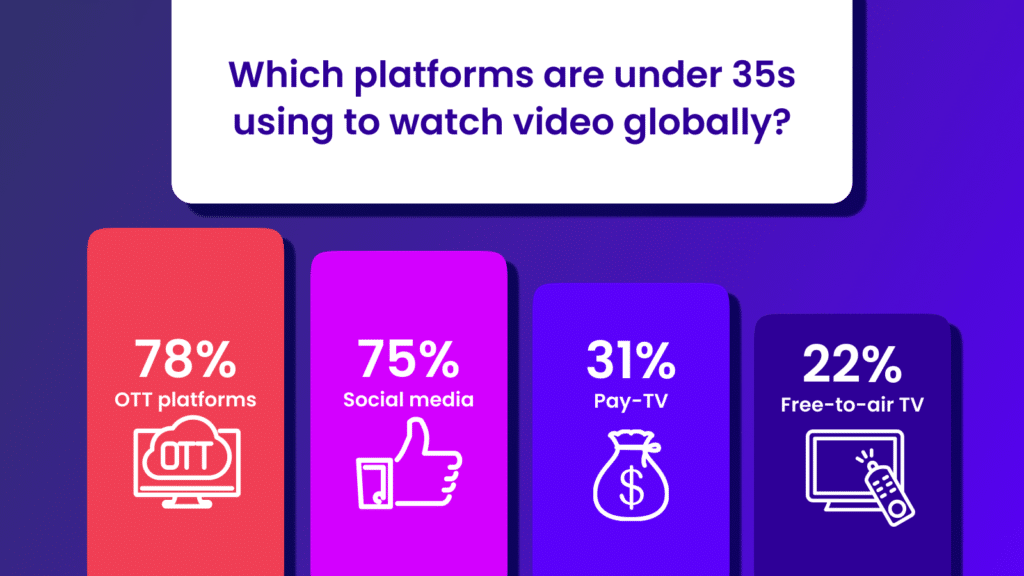

However, the success of NFL Thursday Night Football on Prime Video in the US shows that it is possible to acquire a streaming audience for sports that reaches the levels of traditional TV. More importantly, streaming providers are capturing a younger audience, at a time when pay-TV subscriptions and linear TV viewing figures are declining at an accelerating rate.

In the near future, these fears may be eschewed by retaining control of distribution and going the D2C route. If sports properties themselves can set the price point of their services and ensure their value proposition is appealing to fans, the returns could be staggering. Not to mention the option to negotiate broadcast and additional streaming partners to maximize distribution for certain events.

For major sporting properties across football, tennis and cricket, D2C services could reach new markets and provide consumers with the one-stop-shop for the live sports they want to watch, more flexibly and affordably. The risk is that income is not guaranteed for the rights owner, making long-term partnerships with streaming providers an increasingly attractive alternative. What is clear is that streaming is here to stay and sports will be one of its most important assets.

To speak to us about live streaming sport to your owned and operated channels, get in touch.

Related blogs

Stay in touch.

Join over 10,000 media professionals and register to receive our monthly newsletter directly to your inbox!