The Grabyo 2019 Video Trends Series

Our latest OTT Video Trends Report caps off an insightful year of research.

This year, we surveyed almost 10,000 people across the UK, U.S, France, Germany, Italy, Spain and Australia to find out how consumers are accessing, watching and engaging with video content.

Why? To discover the most prominent global video trends, find out what is driving the change in consumption habits, and plot a potential course for the future of the video industry.

Our comprehensive Global Video Trends Report was a deep dive into the minds of different age groups and nationalities. We explored which devices and platforms are used to view video most often, which types of video marketing drive purchases, and how embedded social media has become in video consumption.

We then moved on to study the world of sports video in our Sports Video Trends Report. Sports is the most popular genre of content globally, and we explored how the media rights ecosystem, clashing with changing consumer habits, is affecting how sports fans access their favorite content.

And last, but by no means least, we explored the world of OTT video on our OTT Video Trends Report.

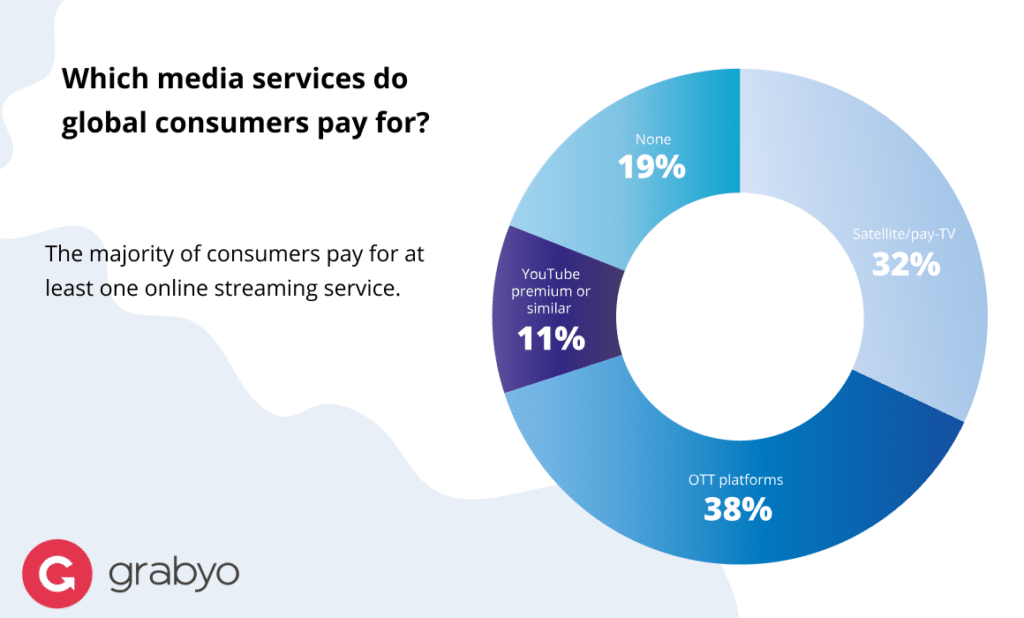

We found the global market penetration of OTT services has hit 38%. As the likes of Disney, HBO and Apple enter the playing field, growth is accelerating across all consumer segments.

OTT platforms are now a more popular choice for video viewing than pay-TV services in every territory we surveyed.

We see that Netflix has hit 54% global market penetration, which rises to an average of 61% within predominantly English-speaking countries. In contrast, Amazon Prime Video has 30% global market penetration.

Consumers are also showing a growing appetite for localized OTT services, across each territory Services such as BBC iPlayer, Canalplay, 10 Play or FuboTV are becoming increasingly popular with local audiences, with an average 22% uptake.

Netflix remains the world’s global streaming champ, but local SVOD and online services are finding an audience in a rapidly growing market, according to new research from Grabyo https://t.co/KPOLg4HDD1

— THR International (@THRGlobal) November 18, 2019

Consumers who use any OTT service on a frequent basis are beginning to consider their cord-cutting options. 65% of consumers who have cut the cord pay for an OTT service, whilst 58% of those planning to cut the cord in the next three years subscribe to an OTT service today.

The majority of cord-cutters are younger consumers, but the data indicates that the rapidly improving quality of content available on OTT platforms is attractive to audiences of all ages.

OTT services are used to view video most often by consumers aged between 26-49. For 18-25-year-olds, consumption on OTT is second-only to video viewing on social media platforms.

Our conclusion: OTT services have become mainstream and are set to become the primary destination for video viewing in most markets. Traditional broadcasters need to evolve TV services to reflect the viewing preferences of modern consumers.

Organizations such as the BBC are successfully transitioning the TV offering to raise the profile and primacy of streaming and OTT services, but more is needed to enable consumers to watch when they want, whenever they want to.

The traditional TV schedule is becoming less and less relevant for many demographic groups and with the upcoming launch of major new OTT services from Disney, HBO and Apple this year, the pressure on the traditional TV model will increase. OTT enables choice, flexibility and better value for consumers, we should expect the growth of these services to continue to accelerate.

Related blogs

Stay in touch.

Join over 10,000 media professionals and register to receive our monthly newsletter directly to your inbox!