What does our 2020 Value of Video Report mean for broadcasters?

This month we released our latest consumer research report into the shifting consumption habits of TV and video audiences globally.

Building on our successful 2019 Video Trends Series, this year, we’ve gone bigger.

We surveyed over 13,000 consumers in 11 territories across the globe. Including the UK, US, France, Italy, Germany, Spain, Brazil, Argentina, Thailand, Japan and Australia.

Our 2020 Value of Video Report explores where the money is going in the TV and video industry today, and charts where spending habits may shift in the future.

What did this report tell us about consumer spending habits? What does it mean for linear broadcasters and pay-TV operators?

Diversify now, not later

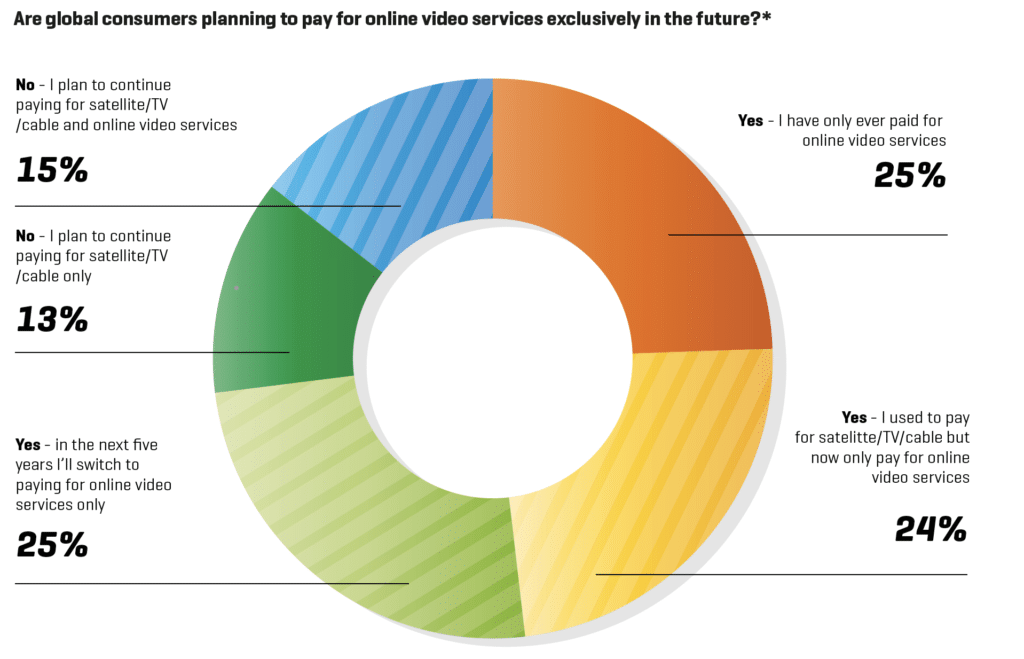

The biggest takeaway from the report is that 75% of video services customers expect to only pay for digital video subscriptions within five years.

To be clear, this doesn’t suggest that the business models of pay-TV or cable providers will be decimated by 2025. What this tells us is that the vast majority of consumers are looking for more choice when it comes to how they spend and the services they want to buy.

Globally, consumers recognize that the digitization of TV viewing is improving the way we watch video, and want the process to accelerate – but they want flexible offerings that meet their demands.

Digital platforms are far easier to access – available on any device at any time. The growth of Smart TV purchasing suggests that while smartphone viewing is a main driver of this shift, audiences still enjoy the TV viewing experience at home.

58% of online streaming customers watch regularly on a Smart TV, while 65% watch regularly on a smartphone. Just over half of pay-TV or cable customers watch regularly on a Smart TV too.

Consumers are telling us that the traditional TV schedule doesn’t work for them, but the traditional TV experience does.

Broadcasters need to start diversifying their delivery mechanisms to suit these audiences. In five years, consumers don’t want to deal with satellite dishes, set-top boxes and long-term contracts. Customer acquisition will be driven by flexibility in consumption and payment options.

The price is right

Unsurprisingly, our 2020 Value of Video report found that price is a front-of-mind issue for consumers.

26% of respondents say that price is the number one reason they have, or are considering, cutting the cord. 36% say that affordability is in the top three reasons for cord-cutting.

The flexibility of online video services doesn’t just lie with consumption, but with price points. Streaming customers pay a low rate on a rolling one-month basis. They aren’t locked in for a year, and can cancel and re-sub whenever they like.

Pay-TV and cable operators need to offer dedicated online services to these customers. The likes of Sky Go in the UK, or BT Sport’s decision to offer online-only services at a reduced price is how the future of TV looks in the eyes of consumers.

ESPN+ has just moved past 7.6 million subscribers in its first ten months, while ESPN pay-TV’s service has lost 4.5% of customers in Q1 2020, and 4% loss in Q4 2019 – which is the fastest drop in its history.

If Pay-TV providers are going nowhere, they need to start delivering services that work for their customers when it comes to price.

We found that on average, consumers in each country were willing to spend up to $35 on online streaming services. When you consider the price points of services such as Netflix or Amazon Prime Video across each market, this total equates to about four or five services held at any one time.

Consumers are willing to manage multiple subscriptions. 30% of today’s global streaming customer base already pay for two or three services. If broadcasters can launch a dedicated streaming service and price these platforms aggressively, the potential revenue in this area is immense.

Profile of a cord-cutter

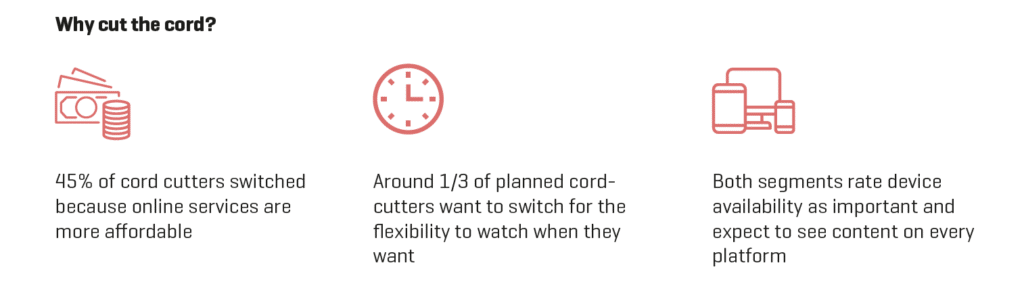

Within our report, we also explore the traits and perceptions of cord-cutters and planned cord-cutters.

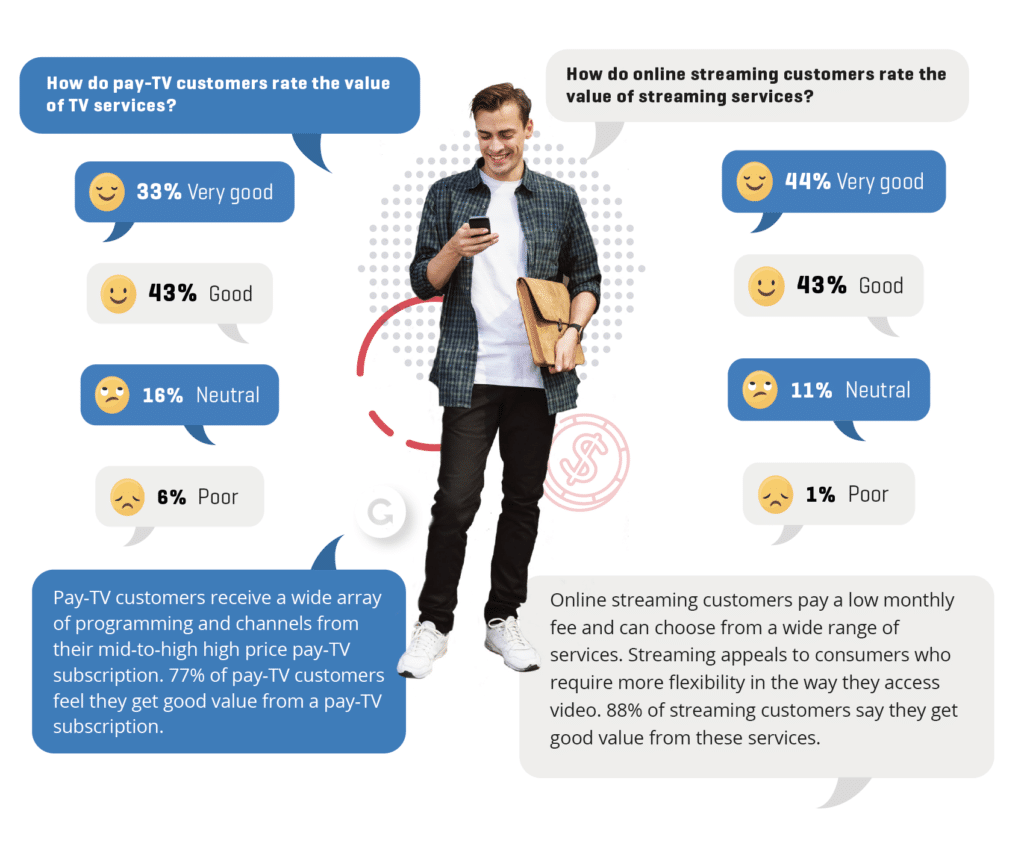

When it comes to value for money, almost half of cord-cutters and planned cutters rate online streaming as very good value for money. Around 25% of this same group rate the value of pay-TV services as neutral to very poor.

This value perception has driven consumers to use online streaming services regularly. 61% of those planning to cut the cord watch video on streaming services at least once a day.

Broadcasters in the UK and US, such as Sky, BT, ESPN, HBO and NBC Universal, have already begun to future-proof their business and provide high-quality streaming content on affordable platforms.

If broadcasters follow the pricing strategies of ESPN+, Netflix and Amazon Prime Video, they are set to scale successfully. What we predict is that consumers will have two or three main services they pay-for continuously, and a couple more that they subscribe to for shorter periods of time, for specific content or events.

The future of TV is the internet, and the future is right around the corner.

Related blogs

Stay in touch.

Join over 10,000 media professionals and register to receive our monthly newsletter directly to your inbox!